Webinar: How the ‘Rona Has Impacted Salon Revenue, Composite Scores, & What You Can/Should Do About It

Ever wanted to know how COVID-19 has impacted revenue in terms of salon services for your beauty school? Watch the replay or read the transcript of the webinar we hosted with Jared Sanders from Lightheart, Sanders, & Associates (LSA), a CPA firm who specializes in beauty schools.

Disclaimer: While we are talking with a professional, the information covered in this webinar should be considered for informational purposes only and is not a substitute for obtaining financial advice from a professional accountant.

Watch the Replay

Read the Transcript

Note: This is a direct transcript of the recorded webinar.

Chris Linford:

Okay, everybody, welcome to our combined webinar. We appreciate you being here with us.

I’m excited for this webinar for a lot of different reasons. We have joined forces with Lightheart, Sanders, & Associates (LSA). We have with us today, Jared Sanders. I’ve known Jared for many years, I’ve seen him around at all of the AACS conferences. He has a CPA firm who specializes in beauty schools.

Jared, I know you work with beauty schools all across the country, helping them with all of their accounting needs, which is unique. There are some very unique needs to post-secondary education and beauty schools, in particular.

So, for this webinar, Jared is going to go first and then Chelsea and I will go second. I actually have Chelsea here with us because she’s an expert. I’m not. If there are any technical questions, she’s going to be answering them.

Chelsea works on our paid ads team. So, she does a lot of social media and paid ads for our beauty schools all across the country. Having said that, let’s turn it over to you, Jared, take it away. Are you able to share your screen?

Jared Sanders:

I think I am. All right. Well, welcome, everybody. We’re excited to be here as well. As we’ve gone through this crazy year, with all of the ups and downs and changes of rules and adding of rules and chaos. When we stepped back and I was having a conversation with Chris, we really just started talking about where our schools are at, what are they facing? And really, what can we do to start preparing for things?

So, one of the things that this particular seminar kind of motivated us to do is to get going on gathering financial data just to see where our schools are at, and see what concerns we have in terms of meeting Composite Score 9010 and really just kind of looking at that.

I want to start off just real quick and go over the rules, please don’t shoot me. I guess a CPA can’t avoid trying to at least talk about the audits and the rules and stuff like that. And then we’ll jump into what we’re seeing and what our concerns are. And then we’ll turn it over to Chris and his team to talk about some things that they’ve seen that could potentially help.

So, the two areas that we want to focus on are:

- 90/10

- Composite score

Just a quick reminder of what the 9010 calculation is. I know that most beauty schools, we know what it is, we don’t ever worry about it, because we have floor revenue, except for this year. So, the key metrics is that you have to derive at least 10% of your revenue from sources other than Title IV and if you fail this score within two fiscal years, you lose your eligibility for Title IV.

So, some people can say, “Well, okay, we can just kind of ignore it for this year,” but we would rather have you focus on it, be aware of it, and try and avoid it at all costs, just to add that scrutiny to you and to your audit.

A couple changes with the beloved audit guide that they still haven’t corrected for us is that the calculation has to be done by the school, it cannot be done by the firm. If you can’t perform that calculation, you’re to engage somebody to do it and this is probably the one that if somebody does fail, would become the biggest issue is technically you’re supposed to have this calculation done within 45 days of the fiscal year end, so that you can notify the department.

It’s not wait until the audit is done and then, “Oh, the audit is going to tell the department that we failed our 90/10,” you actually hold the responsibility to notify the department within 45 days of your fiscal year end that you failed to meet the 90/10 requirement.

Just a side note in terms of the way that the audits work, we know it’s frustrating, we’ve begged and pleaded for the department to loosen up on this concept of any misstatement or any change, if you calculate at 52% and we calculated it at 52.5%, it’s still considered a finding and we have to issue a note saying you’ve calculated one number, and we calculate it on a different number, even though it doesn’t affect anything as it relates to your compliance, we still have to do that.

We haven’t seen the department move on any of those, which is what they promised us, is when we complained to them about materiality and how this was… we really didn’t feel like we should have to issue and deal with the finding, if it didn’t affect the overall 90/10 score. And their response was essentially, “Hey, we’re going to look at it, we’re going to review it, but we’re probably not going to do much on it, unless it’s egregious, but in our position, we’d rather we just rather not deal with it,” but it is still there.

The other side that we wanted to look at was the composite score calculation.

I’m going to spend just a little bit more time talking about the calculation itself, simply from the standpoint of allowing you to understand what the effect of coronavirus and the effect it had on your schools, where it will potentially affect your score.

Again, the composite score calculation, it’s divided into three separate financial ratios. The first one is the primary reserve ratio, which is an adjusted equity divided by total expenses, then there’s an equity ratio, which is a modified equity, which is different than the adjusted equity and it’s divided by modified assets. Then there’s the net income ratio, which is the income before taxes divided by total revenues.

If you just think about what has happened with your schools, you’ve had a period of time where you’ve closed, you’ve had a period of time where you’ve moved to distance education and adjusted to a period where you could at least teach students and move them along but you could not open the floor. Then you have this current standpoint where most schools are in, where you’ve opened up the floor, but you’ve been limited in the number of seats that you can have.

Some states have limited the number or type of services, and stuff like that. Then there’s some states that are just still in the opening process.

On top of all of that you have clients that are concerned about coming into the public and coming into an area, spending time, and stuff like that. All of those have played on the financial aspects of the beauty school.

So, things like incurring a lot of expenses, with very little revenue, that’s what we call equity churn. It means for those that tried to keep operations as normal as possible from an expense side, without that income, you were burning through your money, your cash reserves, and stuff like that.

That’s going to pull down your equity ratio and your primary reserve ratio, as well as your net income gets hit, because now you don’t have this revenue coming in.

We’re seeing a very stressed approach in terms of the composite score. We got a little bit of relief with PPP. If you receive PPP money, the department has basically said as if the auditor can see after your fiscal year end that you either did receive forgiveness or can look at the documents and verify and attest that you’ve met the requirements for forgiveness, they will not include that in your ratio, which is great news.

Because for a lot of schools, that was a large liability coming on the books, the cash outflow is going to pay salary and stuff like that was not generating revenue and return. So, we saw a pretty hefty shift in composite score calculations if you don’t meet that.

One of the main things, as it relates to a composite score calculation, that we’re trying to emphasize is make sure, and we know schools are doing this, make sure that you meet the requirements for forgiveness.

Now, it really shouldn’t be that difficult if you’ve kept up with your payroll, because the amount that they lent you was on 10 weeks of payroll, and you now have 24 weeks worth to expend that. So, if you kept your payroll numbers, you kept your staff and stuff like that or brought your staff back on, you should have plenty of money to cover that into almost 60-70%. So, you don’t even have to dip into the other items that those funds were eligible for.

It should in theory be a good, easy, clean thing for an auditor to look at and say, “Yeah, you expended it, you met those requirements,” and stuff like that and add that note. You have to make sure in your audit report that they do add that note letting the department know that it’s not to be included, and then the department will be good on it.

With the composite score calculation, it’s done on your annual numbers. So, the most important thing is the last day of your fiscal year, December 31 for a lot of schools.

That means that you can do lots of things to help your score on December 30. But there’s very little that you can do to help your score on January 2nd.

This is something that we’re trying to remind schools that they need to be looking at it. I know that schools that were stressed or even more stressed about it, even schools that had great scores in the two to three range need to be aware of it, they need to understand the direction that their financials are heading going into the year.

The fact of the composite score, it’s a range between a negative one and a 3.0.

Above 1.5

You’re considered financially responsible and the department and accreditation don’t harass you with financial standards.

From 1.0 to 1.4

You’re considered to be in the zone. That’s just a yellow flag, which the department could ask for heightened cash monitoring, one, which is more of a just a reimbursement process, you post things or a letter of requirement.

You can only be in the zone for three consecutive years. So if you’ve been in a zone the last couple of years, this becomes an even bigger issue, potentially harder for schools to get out this last year.

Below 1.0

If you’re in that .9 to -1.0, you’re considered not financially responsible. The department will put you on heightened cash monitoring, too, which is much more stringent. The cash flow slows down considerably, that will also increase the potential of the letter of credit requirement on you, as well.

Then, from a creditor standpoint, like for example, NACCAS, should go on quarterly monitoring and a whole bunch of other issues along those sides.

Some of the things that we’ve seen, what we did is, we reached out, grabbed as many financials from our clients as we could, we got a good number back. We looked at January 1 to June 30, being the last quarter that was complete and what we saw was the floor income dropped 48% from prior years.

So, if you looked at January to June of 2019, and compared it to January to June of 2020, it dropped almost in 50%. The average drop in floor income per school was about $85,000. And, the change in the 90/10, because of the drop in the 90/10 cap, because of the low clinic, was almost 14%.

This is based on last year’s tuition number and a projected floor income number if things continued in the direction that they have.

We also reached out to a lot of schools and asked them to give us an estimate on floor activity. Most have responded back, it was about an average that they’re currently seeing about a 40% less than prior year decrease in their floor activity.

The last thing I thought was interesting is that most schools are reporting to us that they’re seeing an increase in students. We have a lot of schools that are booked out, their class starts for the rest of the year full. They’re seeing a good influx of students, which is awesome in terms of our industry in terms of our schools, and stuff like that.

The consequence, or the concern on some of these things is for floor income, that drop, you also have to remember that for at least two months, we’re at 100%. Till the end of February, most schools were still operating in a full regular environment, so a third of the time period looked at, which I think skews that number of the floor income a little bit, I think that’s why we’re seeing a 40%, in terms of activity going forward.

When you project that out to a longer year, that’s going to put some stress on your 90/10.

You could look at say, “Well, my, my score was 10%, or was 50%. So if I go up to 65, it’s not a big deal.” But, what concerns us is that if your students and population is increasing, your students are getting back into it, you’re getting more tuition, you’re getting your revenue from your tuition ramped up, but you’re not getting your floor revenue ramped up.

It’s going to increase that effect, because your revenue from tuition, which in general usually comes from your Title IV purposes, is going to jump back up, but your floor is not going to recover.

Some of the things that we talked about or felt like is, is that most well-run schools, typically you’re under 75% and you’re on top of that ratio. But, as I said, if student levels are increasing, and your floor doesn’t increase, that’s going to put some stress on it. And then what we’re seeing as well is that students have less savings or personal means to pay for the school and that’s going to really affect, push more money into Title IV.

Composite score, like I mentioned, a lot of schools burn through equity to keep your school open, or to keep your employees going. The drop in clinic revenue is huge, and that you’re making less per student, you’re having… a lot of us don’t think this way, but in many ways your tuition is offset OR subsidized by what the student brings in on their floor.

With that being decreased, you’re now making less per student.

All of these things are putting more pressure on your equity score. When you’re using your reserves to support operation, it really puts stress on both the equity and the primary. Having months of not having revenue is going to put pressure on your income. So, all three of your scores, as it relates to a composite score, are really being stressed this year, in terms of what’s going on.

What we recommend is that you know your school. Don’t assume that from a prior year, you’re good. Understand the strengths of your school as it relates to the composite score, and have a conversation with your auditor, whoever’s in charge of making sure that you’re doing good. Do this calculation now, do it at the end of September, do it at the end of October. Get a good feel for what you need to do before the end of the year, so that you can make those changes to handle those things.

At this point in time, there’s no specific relief from the department on the composite score calculation. There’s been discussions, but there’s also a debate about whether or not they even have the ability to loosen those without legislative involvement.

Things that you can do: be aware of what needs to happen, and then look for solutions outside of the box. For 90/10, look for scholarships, workforce development, or other aid programs that, especially as the states are rolling out different programs they’re all trying to help people, that may be different areas that you can bring money in.

Lastly with 90/10, and also with equity, is to find ways to increase your clinic traffic and increase your client per revenue. Maybe you can’t get as many people into the door, so the focus needs to be on trying to increase the value of every person that comes into the clinic and doing things like that.

And I think with that, I’m going to turn it back over to Chris and Chelsea and they’re going to focus on their side of things.

Chris Linford:

Awesome. Thanks, Jared. Appreciate it. I’m just going to share my screen. Hopefully, we can make this happen seamlessly. All right, Jared, are you guys able to see this?

Jared Sanders:

Yep.

Chris Linford:

Okay. All right. So, here’s what I want to do, I want to get interactive with everybody because givers get, right? We’re a network of schools, we want to help each other out. So I want to utilize chat right now, the chat feature.

For those of you who are on, pull up the chat. Maybe Chelsea, you’re going to have to monitor the chat for me, but in the chat, I want you to answer this question, how many visits before a client becomes a customer? And I’m talking about your salon floor. Because somebody can come in, they are a client, but how many times before they actually become a customer?

How many visits do you think that’s going to take? So, in the chat, if you guys can put in there? I’m looking at it right now.

Okay. Somebody says three times, two times, three, three, one, three.

So there’s a trend here, so the correct answer from my studies, and who I’m talking to people is three. I like the one like if you can just get them there one time, and you’re going to provide such a good experience, they’re going to become a customer for life. That’s good.

Typically, it’s three.

Usually, if they come in about five times, then they’re going to be a loyal customer, which is different than a customer to a loyal customer. So, that’s what we want to do.

Jared, you were talking about increasing salon floor revenue. We’ve got to get the clients. How many of you on here, your salon isn’t open yet? Is there anybody in any state where you’re not allowed to see clients and guests? Maybe certain cities have had restrictions, not completely.

I know that there are some limitations and there are some mandates, which can make it hard to perform services and to really give a great experience.

Somebody says that New York State is still 50%. I guess maybe if you’re a politician, it doesn’t matter where you live, you can go into a salon and not wear a mask.

But, there are limitations and so what we want to do is… so, how do we get them in the first time? Because that’s the hardest part, right? We’ve got to get them in that first time, and then to get them to come back is a little bit harder.

What I want to do is, I want to focus on where your marketing dollars and your money should go to get that first person to come in. And then we’ll talk about some incentives and so obviously, we’re a marketing company.

So, you might think like, “Oh, I’m going to go into maybe like programmatic ads, geo fencing somebody else’s salon or school, or the great clips and let him know that there’s another option.”

I’m not going to get into that. As much as I would like to as a marketing company, one of the most effective ways of getting new clients to come into your school salon, the very first time, where your money should go and your effort should go here.

It should go to your students. Your students, a new student, whenever they come into your school, they bring with them a network, a client pool for your salon. This is where our focus should be. This is where our marketing dollars should be.

Now, in the chat, let’s talk about marketing dollars.

How much of your salon floor revenue are you investing into marketing? If somebody wants to be brave, and even Jared, you, what is your suggestion? What do you see works? Somebody says 3 to 5%. 25%. Fantastic. That’s certainly on the high end. Typically, in your marketing, and this is true just for a school in general, if you’re trying to market for admissions, typically, it’s the 10% rule. You always hear 8 to 10%. Sometimes it’s 15%, it’s kind of between 8 and 10, mostly.

Think about those dollars and how they can go here to our students.

There’s a particular type of student that we want to focus on in bringing in their friends and their family members. When I travel to schools, I’ve been traveling to schools for seven or eight years teaching social media marketing, and one principle that I share with them, the difference between good marketing and great marketing is good marketing is talking about ourselves.

That’s great, we need to be doing that great marketing is getting other people to talk about us, to do our marketing for us.

Specifically, I want to focus on your new students. Now, Jared, you talked about schools receiving an influx of new students, which is great. This is good news for you. Because with all of these new students comes their network of friends and family members.

How do we work with our students, incentivize our students to bring in more of their friends and family members? Let’s get into that. We’re going to talk about incentives because incentives work. Some shouldn’t work, though, and I’ll get into this near the end of the presentation, on some incentives you should not be doing.

I’m not an expert on accreditation, and the different states and laws and rules. But, is there anybody who’s on here who you’re not allowed to incentivize your student in any way? Maybe not.

Most schools, most states that I’m aware of is, we can do fun contests and fun incentives for our students, which is a good thing. So, let’s get into a program of incentives that I know works for schools. When I get into this program, I first want to thank Jackie. I don’t know if you’re on, but if you’re on, I want to thank you for this. This is what she has done in her school. And it’s been very successful.

Like I said, I’ve been to a lot of schools, and you can tell their salon floor if it’s really successful or if it’s super slow.

So, Jackie’s school salon is just really successful. How does she do it? How does she incentivize the students? It looks like we have a comment, but it’s about incentivizing students. “But as easy as friends and families come with the student, those friends and family members will also leave when the student graduates,” which is true and we want that, right?

So, they’re going to bring in their friends and family members and when they graduate, they’re going to take those clients with them, we want that. That’s why we’re focusing on our brand new students. Students who are about to get onto the floor, incentivizing those people to bring in their friends and family members so that they are customers throughout the journey with the student, and then they leave with them.

As long as you’re enrolling new students, you should be getting new salon clients.

Let’s talk about how these incentives work with students and clients because we can or we shouldn’t incentivize both. So, let’s talk about a guest incentive.

A program would be, we’re going to work with our students and we’re going to give them let’s say 50 cards, they can be digital cards or physical cards. And, on this card, a student will go to their network and say, “Hey, here’s a 50% off, basically a coupon to come in to receive services.”

When they come in and they actually redeem it, then they’re going to get a second card with a 25% off coupon, and then when they come in to redeem that, then they’ll get a third card, which is a 20% off. So, basically what we’re doing is we’re incentivizing and we’re encouraging those three visits.

It’s a good strategy to incentivize these new guests. This is a really good way to work it. But let’s talk about the incentives for the students. So how do the students incentives work in this program? Well, if you are a student, let’s say I’m a student, I’ve got the 50 cards, I give them all out. If 25 people or 50% of the cards that I give out actually come in and redeem, then as a school owner, I would incentivize that student with a $100 cash card. That’s their incentive.

They’re bringing in new clients and guests for us, they’re getting 50% off. If I’m a student and half of those people redeem those cards, I get a $100 cash card. If the second half comes in and redeems, so if all 50 people come in and redeem, then I’ll get an additional $50 cash card.

Then, you work on your different tiers.

If you have half of the people that come in to redeem the 25% off, then there’s a $50 cash card, and then the second half comes in, you can do $25. Make it your own, figure out what works for you.

But, you can see what we’re doing here. The money that we would have spent on marketing, like in a Val-pack, some sort of mailer, or traditional forms of marketing, let’s take that money, and let’s give it to our students. Because, if we can help make our students happy, they’re having fun, they’re being incentivized, they’re making money, they’re going to say really good things about our school.

We also know that not only are students a good way to bring in salon clients, but a great way to also bring in new students. We want them talking about us.

Specifically, let’s get into that a little bit. Some incentives that should not work. And this is kind of just a pro tip outside of this program.

What we do at these meetings with our clients is we consult with them a lot on getting Google reviews. Getting more Google reviews is one of the best things that all of our schools across the country can do to bring in more long-term leads.

What we do is we teach the students how to ask for that Google review. Then when they get the Google review, we encourage them to take a screenshot of that, include those in their portfolio, so that they can showcase those soft skills, which are crucial. Which, salon owners and managers, they’re looking for those soft skills, more so than the hard skills.

Back in the day, six, seven years ago, we actually used to incentivize the guest.

A guest would sit down, this is an example of a mirror cling, the one on the left side of the screen where it says, love your service, we want to hear about it. And we said, “Hey, client, if you do leave a review, you can get $10 off any retail product before you leave.” It worked.

But, what we did is we stopped doing that incentive, because what we realized is you didn’t have to give the client anything in order to get a Google review, all you had to do is ask.

So, we put the emphasis on the student and that it was so important for them to get a Google review, it would mean so much to them if their client left them a Google review. We made it personal and we got not only the same amount of reviews, but the reviews were way better. They were focused on the student and the guests felt really comfortable and just felt good that they were helping this up-and-coming beauty professional by getting a review because they were trying to promote themselves and build their businesses. So it was a-win win.

Chris Linford:

So you can see the difference between these two.

And at the very end, what’s always funny is if the client or guests didn’t love their service, we want them to call that number instead of leaving a review. But still, they can leave a review and actually, if somebody has a negative experience, they’re more likely to leave a review, they’re more motivated.

That’s why we always need to be asking for positive reviews. But don’t forget about the reviews from your students. Those are the most important ones.

Here’s the thing, if you involve your students in your review program, which is a good thing you should be, you’re going to get a lot of client and guest reviews. Now if people are searching in Google for salon services, they find the school, they’re going to see hundreds, they should see hundreds of reviews from happy clients and guests that’s going to instill trust and confidence.

They’re going to come in and get service. Even if somebody was referred to your school, let’s say your student hands out their cards and like, “I don’t know about going to a school for beauty services, I’m going to look at some reviews.” They’re going to look at those reviews and they’re going to see that they’re awesome and they’re going to have confidence and they’re going to come in.

So, just a little pro tip there on reviews and incentives, some work some shouldn’t. So just remember that with Google reviews.

Let’s talk about student incentives. A successful program is not only incentivizing students but giving them great recognition, and we know that recognition is actually more motivating than money and prizes and so on. I don’t want to ignore that element in all of this.

And I would hope that most schools have their weekly business meeting, because business is the lifestyle of the industry. It shouldn’t be just one class, where you focus on it for a week or something like that in your curriculum. We should always be talking about business, the soft skills.

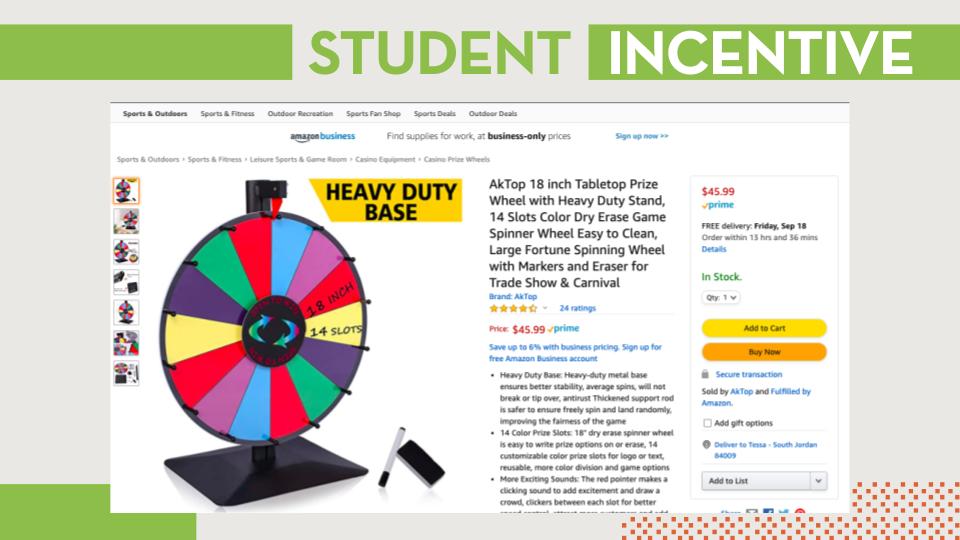

Going back to the student program. So, if I’m a student and I have 25 people redeem that 50% off coupon, for every client that I bring in and who books an appointment and shows up, every single one of those appointments, should go to the wheel and spin it in the school to win cool prizes.

So, investing in one of these, I think it’s a great idea. It makes for a fun culture. Every time a student gets an appointment, they come in and get booked, they get a spin and they get to win a prize. Again, the money that you’re giving away in prizes here normally would have gone to marketing, different traditional forms of marketing. Take that money, invest it in your students in these prizes in these giveaways.

In the chat, what I want you to do is: what types of giveaways and prizes do you think will be motivating for students? Because it has to be motivating, right? They get to spin the wheel, but if the prizes on there are lame, they’re not going to be excited about it. So, what do you think will motivate your students? What kind of prizes or giveaways would you have kind of on this spin the wheel.

Okay, we have Starbucks gift cards, for sure. What else? Money, for sure, having cash cards on there, cash is king. Tools to expand their kits, we’ve got different gift cards, gas cards, that’s huge, right? Free products, different tools, “Queen of the Day” spa services, love these, these are all great ideas, gift certificates to beauty supply. For sure. These things are all super important and highly motivating.

We’ve run so many social media contests for our schools, and I’m telling you prizes and giveaways can make or break any contest. So again, budget for this, and let’s say you have a student that drops or they’re not bringing in anybody, the money that you would have budgeted for them, put it into the giveaways to the students, make them awesome.

I haven’t seen any suggestions, but what if you get to wear a certain color or a free dress day or jeans or something like that. I know sometimes that can be motivating for students, but you know you students better than anybody else. Get those prizes on there and make them worth putting in the effort to get. This just creates a fun culture within the school. Recognition.

And you can even use this wheel for different incentives. Jared, you mentioned different upsells. Like, if you bring in a client, like what can we do to maximize the revenue from that client? It’s selling them products, doing product contests, and including this, just making this part of your culture is giving back to the student. Again, we want to incentivize our clients, we want to incentivize our students, it’s a win-win.

Chris Linford:

Let’s see, we have another comment, payment of fees for testing, or their first license fee. That’s interesting. That’s cool. I like that. All these really great ideas, thank you, for everybody who’s been participating.

So, I’m talking about this program to incentivize our students, but here’s the thing: you should still be marketing your salon services, you should still have monthly salon specials. And there’s no better way to just market these to try to get in front of a new audience, than on social media.

This is just an example of a post. I think it was of a school’s August special. Let’s see, we have a comment here. “If you put the wheel on the floor, all clients also see the fun the student who is spinning gets, so they too want to participate in the fun.” For sure, part of the culture, right? Make it fun, let the client see it. They feel like they’re part of something exciting. It’s exciting for them, too. I love that comment.

All right, you should be having monthly salon specials and you should be promoting them. Obviously, you can get your students to share them. They should be, you should be encouraging that. Maybe do a contest for them. You can see who has shared, who’s commented on it or who’s tagged a friend in there.

But, you can also put some money behind it. Because the truth of social media is if you want to play, you got to pay. So, there should always be a promote or a boost button along with these, at the very least you should be doing that. Taking a small percentage of your marketing revenue and putting it towards marketing your salon specials on social media.

What I want to do is, I’m going to post a link in here for you, if you look at the chat, there’s a link to a free guide that we put together that you can download that gives you all the best practices for boosting a post.

Just kind of some highlights on there is, we go over very careful demographic targeting, how to tighten up your audience, how to set a schedule with the budget in mind. And also, within this document, there’s a link to a document on how to take your boosting or your social media advertising to the next level, outside of the boost button and using Facebook Business Manager.

You have way more capabilities of targeting and things that you can do to get in front of a better, more targeted audience. But, if that’s not a route you want to go, if it’s too complicated, still, at the very least, you should be boosting your posts.

The last bullet point on here is the 20% rule. That actually went away I think just in the last week, Chelsea, are you there? Can you talk about that?

Chelsea Owens:

Yeah, and we were just talking about it as a paid ad’s team yesterday, actually. We just found this out. Facebook used to not allow your ad images to have more than 20% of your image be words, or just letters and those types of things.

But, that is no longer a policy of Facebook’s anymore. So, if you wanted you could have your whole image just be a big paragraph of words. However, that is not suggested. Take advantage of the caption that Facebook gives you, put the information there and use your image for promoting. I don’t know, what your salon looks like, or your happy students, or things like that.

But yeah, the 20% rule is no longer a thing, which is kind of awesome at the same time.

Chris Linford:

Yeah, right? So, we have people commenting on, you could have a graphic now with a huge sign: get a free haircut, or using more text. But, like you said, it’s probably not going to work if you just have a big paragraph.

Nobody likes to read, they do like to see a great image. So you have to be conscious of that. I think if you’re using Business Manager, you can split test some ads, you can test them, and see what is more effective.

So, we would encourage you guys to play around with that. Some of your marketing revenue, obviously invest in your students, but invest in social media marketing, it’s effective. And don’t be afraid. If you really want to get in front of a new audience, do some really crazy specials.

We’ve had schools in the past where it’s a $5 or $15 or $20 experience where you come in and you get a color and a hairstyle, a blowout, just different things like that to get in front of new audiences. And, we’ve seen those ads on social media go like crazy. People are sharing them, they’re such good deals, it’s kind of a lost leader, testing those things.

But again, the majority of your marketing dollars should be invested in your students for your salon services, instead of in a Groupon or something like that. But again, like we’re a marketing company, we’re all about testing, test it, see if it’s gonna work. And if it does great, keep doing it. Keep tightening, keep testing.

That’s all that I have that I wanted to share with everybody. And so what I want to do is basically just kind of open it up now to a Q&A. So Jared, if you want to turn your screen on Chelsea, if you guys. If there’s anybody out there who has any questions based off of what Jared or I said, any other questions on marketing, how to boost a better post, we can get into that using Facebook Business Manager, we’ve got Chelsea she’s an expert.

So, go ahead, fire questions away if you have any. And if you don’t have questions, that means we’ve just done such a good job, we’ve answered every question.

Let’s see. Okay. “Should I still use postcards or mailers to promote my salon specials?” Again, it’s all about testing, right? Test it. The money that you would have spent for those postcards, give it back in incentives to your students or percentage off like what we were talking about, the 50% off, 25% off, 20% off. It’s all about testing and seeing what works.

So the example that I was sharing was, they did test that and they have found that investing those dollars back into their students was a better ROI for them.

Come on, there’s got to be more questions out there, especially for Jared, you’ve got a CPA right now that you can ask questions, you don’t have to pay for it.

Let’s see, “My school’s in the low income area, and students really struggle to sell products. How should we market products?” That’s a great question. And I would say we’ve got a bunch of experts who are on this webinar, answer in the chat there.

How do you help maybe in these more urban areas, how do you help them sell products? What I have found to be true is a lot of people just aren’t asking for the upsell. And you’d be surprised how successful you can be if we’re just asking everybody, make it fun, make it a contest.

Let me go back to incentivizing on products. When we did do that incentive for the Google reviews, we gave them $10 towards any retail product before they left.

What typically happened is salon product sells doubled. So, maybe you can do some heavy discounts to sell more. But, if anybody in the comments wants to comment in there, like what you do to help sell more products, let’s help each other out.

Jared, Chelsea, any ideas from you on that? Okay, let’s go to some other questions here. Let’s see.

“What percentage of total income should come from the clinic?” Jared, that’s a CPA question. Oh, you’re muted Jared.

Jared Sanders:

Darn technology. My bad. That’s a good question. A lot of it depends on your location, the type of students that you have. We typically suggest, let me pause for a second and just say, the reality is we often use the percentage of clinic revenue as an indicator of how busy your students are actually on the floor, which is a huge indicator of happiness of your students.

So, for us, we encourage people to be at least 25% so that your 90/10 is coming in below that 75. But really good schools that we see a lot of, I mean, in some ways, it’s kind of common sense, but if you can push that number down to the 60, you could almost have a correlation in terms of student happiness.

The busier they are on the floor, the happier they are from that standpoint. At a minimum, I would be really nervous if I was sitting at 25% floor income to tuition, I would really want to see it closer to 35%, just to give you that general aspect of that number.

Chris Linford:

Awesome. Thanks, Jared. I think the next question is for you, too, “Is the PPP proceeds and the HEERF grant included in 90/10?”

Jared Sanders:

Don’t you love how the government’s just giving money and not giving any rules or guidance until after you’ve spent it? So, in terms of 90/10 that’s a great question, because, so the PPP and the grant, in theory, if you relate it to GAAP and I know everybody just went blank because I spoke accounting, but generally accepted accounting processes or principles, right. So your PPP forgiveness, according to GAAP, technically is a debt forgiveness, which is another income item.

The HEERF grant is grant money, so GAAP says that you treat it one way. As it relates to the department, I don’t think that they’re going to let you count it even though some of that HEERF money went to students and stuff like that. Composite score’s another question if it helps you with your income statement, they haven’t said anything.

So, the department could come back and say, “Jared was wrong and this is how we’re going to do it.” But as of today, all indications that we’ve been given is that they will not be included in your calculation.

Chris Linford:

So, speaking of things being included in the calculation, we have a question, “Does the sale of products go towards the 90/10 ratio?”

Jared Sanders:

No, it has to be services, it cannot be product.

Chris Linford:

Okay. So I mean, there it is, right? If you can upsell different services, somebody had a suggestion of incentivizing pre-booking people and things like that. Okay, “The point is to get the sale, not to make money.” Good suggestion. “From personal experience, this wasn’t even that expensive a product, but I was apprehensive on spending like $25 on some. It was a product a barber was trying to sell me, eventually I went for it and I just ran out like last month, I had it for like a year. I think it helps when stylists can get you to understand how long the product they’re buying will last. And even if you are in a poor area, you can factor in what the costs would be over time and show the value in them.” That makes sense. “It was late to respond.”

Okay, some more questions for you, “The department has made it clear that HEERF is not counted for 2010.”

Jared Sanders:

Correct.

Chris Linford:

Jared, “What about the payroll tax deferral?”

Jared Sanders:

So the payroll tax deferral, the problem with that is you’re kicking it down the road. So technically, from a GAAP perspective, it’s still going to show up as a liability. So, it’ll actually hurt your composite score.

The way that that payroll tax deferral essentially works is it’s allowing you to put off paying those taxes for the next year. But from an audit standpoint, from a financial standpoint, you’re going to have to put that money up. So it’s going to go down as a liability and it’s not a long term associated with fixed assets, so it’s going to hit your score pretty hard.

Chris Linford:

Okay, this has all been really awesome.

Talk To Oozle Media

If you want to learn more about stepping up your marketing game, and getting the resources you need to incentivize students to ask for reviews, get in touch with the team at Oozle Media. We’d love to help you out to make the most out of your marketing dollars.